By Dr. John Ormerod

Technical Adviser / Bunting-DuBois

Introduction

It’s interesting to note that no major new permanent magnet material has been introduced since NdFeB in the 1980’s; in fact, it’s now 35 years ago since the announcement of NdFeB magnets at the 29th MMM conference held in Pittsburgh, PA in November 1983; a long time ago but a few of us are old enough to have actually attended the conference! This does pose the question that after all this time “Is it time for a new magnet material breakthrough?”

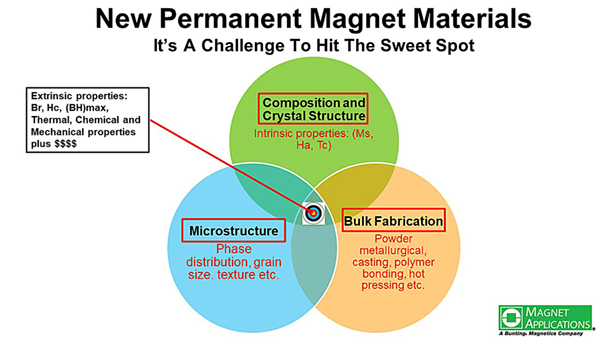

So it has been over 30 years since NdFeB magnets were introduced and commercialized. Why is it we are still waiting for the next big thing to replace NdFeB magnets? Well, discovering new materials and compounds for permanent magnets is really, really difficult. First, we need to find a composition or phase with a uniaxial crystal structure that demonstrates suitable intrinsic properties of Ms, Ha and Tc. Next need to develop a microstructure the impedes reverse domain nucleation and growth plus for an anisotropic magnet need to develop macroscopic texture. Finally, even if you have these first two difficult challenges solved you have to be able to fabricate useful bulk shapes in mass production volumes e.g. some interesting properties have been reported by ion implantation methods; which is great if you need a few grams on a very thin foil but not practical for producing 1000’s of tons of bulk product.

Now all these problems must be solved within a very small over lapping window to commercialize a new magnet with the necessary extrinsic properties of Br, (BH)max, Hc etc. Also, the economics of raw materials and processing have to be commercially viable; so perhaps it’s not surprising we are still waiting!

Some new magnet material developments

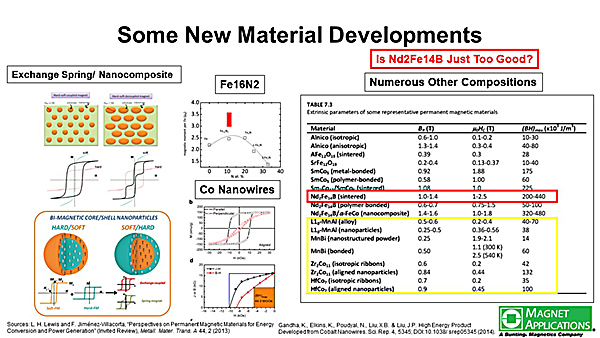

So, here’s a snapshot of current new magnet material developments (although most of these have been around for more than 10 years). The concept exchange spring or nanostructured composites have been known since the 1980’s. Simply, they are a combination of hard and soft magnetic phases that interact and combine the high Ms of the soft phase and high Hc of the hard phases. However, in order to develop the required exchange mechanism a very precise phase size, morphology, distribution and interpose separation is necessary. This has proven to be a significant challenge to reproduce in bulk materials.

Fe16N2 is somewhat the holy grail of PM materials since it combines high Ms and is RE-free. However, synthesizing the compound and developing Hc has proven elusive to date.

Co nanowire have developed (BH)max values of 44 MGOe (interestingly the coercivity mechanism is shape anisotropy).

There are numerous other compositions e.g. MnAl, MnBi, ZrCo, HfCo etc. but none have the raw material benefits or properties or economics that rival Nd2Fe14B. So reluctantly I must acknowledge that Nd2Fe14B is really good and maybe even too good!

The next mass market magnet composition; my prediction

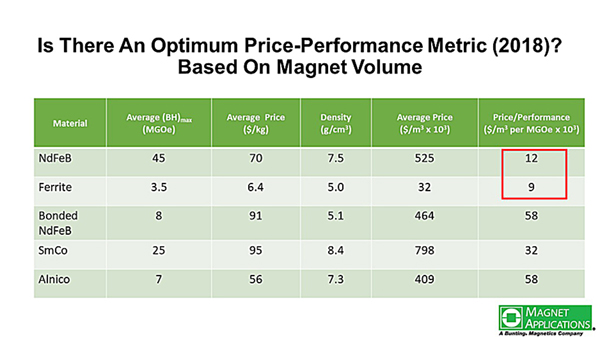

Here is price performance analysis based on magnet volume and using the 2018 market estimate (www.linkedin.com/pulse/rare-earth-magnets-yesterday-today-tomorrow-john-ormerod/). I have estimated the average (BH)max for each material type, the average price/kg from my earlier market estimates and then converted the price/kg to price/volume using the densities of the materials and finally divide price/volume by average (BH)max to arrive at my new price/performance ratio. Again, NdFeB and hard ferrite materials have the lowest price/performance ratios. However, note that hard ferrite now has the lowest price/performance ratio reflecting its relatively large market share despite its inferior properties compared to NdFeB.

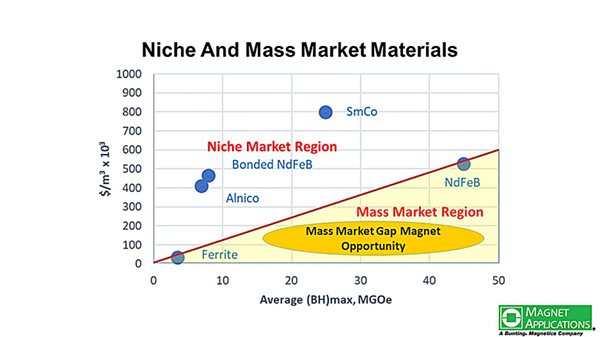

In this next chart I’m plotting the $/m3 versus average (BH)max of the different material types from the previous table and drawing a line with gradient of 12 representing the division between what I am defining as the niche and mass magnet market materials.

So, let’s return to the gap magnet opportunity I talked about in my previous article (www.linkedin.com/pulse/rare-earth-magnets-yesterday-today-tomorrow-john-ormerod/). I argue the opportunity for mass market gap magnet exists in the entire yellow region. Obviously there are a wide range of (BH)max values now possible however if my price/performance metric concept is an indicator of overall market success then the $/m3 of the new magnet materials will need to be such its price/performance ratio is less than 12. And that may be the most difficult challenge to overcome for a new mass market magnet material!

So, I’m often asked what is going to be the next big thing; honestly I don’t know but that is not going to stop me offering a few thoughts and ideas.

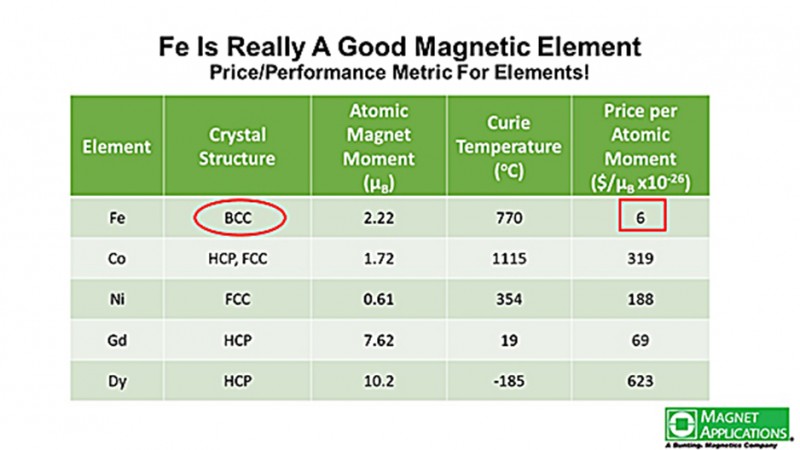

First, it terms out the iron is an excellent magnetic element. Here I’m comparing the ferromagnetic transition elements plus a couple of REE’s. First column shows the crystal structure of the element. Next, I’m comparing the atomic magnetic moments of the elements i.e. magnetization at the atomic level. The atomic magnetic moments are based on the fundamental units of magnetization known as the Bohr Magnetron. A Bohr Magnetron is the magnetic moment of an electron caused by the orbital or spin angular momentum of the electron. Interesting to note that the 2 REE’s have the highest moments but unfortunately very low Tc’s. I then tool the current price of each element per kg and using the atomic weights and calculated the price per atom. Then analogous to my magnet price performance metric I divided price per atom by the atomic magnetic moment and arrived at price per atomic magnetic moment. And by far the most efficient element is Fe. Of course, the metallurgists and materials scientists and even physicists must find suitable alloying elements to convert the BCC crystal structure to something uniaxial and hopefully with a significant Ha!

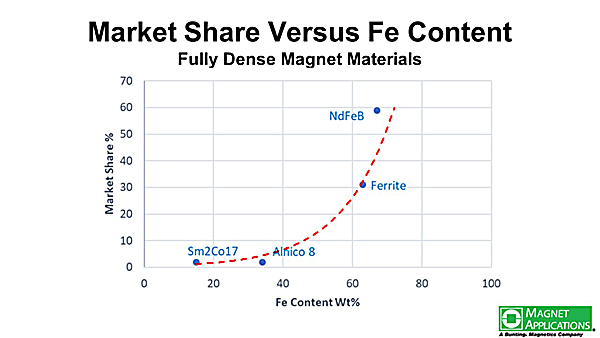

Another plug for Fe; here I’m plotting the market share based on my earlier market analysis (www.linkedin.com/pulse/rare-earth-magnets-yesterday-today-tomorrow-john-ormerod/) versus Fe content for the 4 fully dense magnet types; now I’m the first to confess that correlation does not mean causation, but I trust you’ll admit it’s an interesting trend; the more iron content the higher the market share.

So finally, here’s my prediction for the composition of the next mass market PM material; it will contain lots of Fe!