by Dr. John Ormerod

Since our last update in Q4 2020 the news has been dominated by several major issues: the speculation of the sale of a major industry player; the continuing increase in rare earth prices; and the acceleration of the electrification of transportation.

Let us discus each of these topics in more detail below.

Potential sale of Hitachi Metals Limited

The rumor of a sale of Hitachi Metals Ltd. (HML) began in late September 2020 when an unattributed source was reported by UK Reuters. The article quoted “three people with knowledge of the matter said” that Hitachi Ltd plans to launch a sale of its materials unit as early as next month.

So, what exactly is Hitachi Metals Limited? You may know it as a prominent NdFeB magnet producer, but it is much more than that. Looking at their latest financial report (FY 2019 ended March 2020), HML is split into 4 major business units. These are:

Specialty Steel Products – molds and tool steel; rolls; industrial equipment materials; aircraft and energy-related materials; and alloys for electronic products.

Functional Components and Equipment – casting components for automobiles; piping components.

Magnetic Materials and Applications / Power Electronics Materials – rare earth magnets; hard ferrite magnets; soft magnetic materials; and ceramic components.

Wires, Cables and Related Products – electrical wires and cables; automotive components.

When you are inside a business, it is always tempting to believe that the various product groups and lines have some type of overarching synergies. Now, there is some synergy within HML as it relates to automotive and EV markets. Other than that, though, it appears to an outsider as essentially a diversified manufacturing business with a variety of metallurgical and ceramic processes supplying products to several unrelated markets, industries, and applications.

Looking at their most recent annual financial data for FY 2019, here are some of the highlights:

HML Revenues ¥881 Billion (-14% year on year)

HML Income before tax ¥-41 Billion (-84% year on year)

Magnetic Materials/Power Electronics Revenuers ¥117 Billion (-15% year on year)

Magnetic Materials/Power Electronics Income before tax ¥-43 Billion (-52% year on year)

Looking a little further into the Magnetic Materials product group, one sees it actually represents the smallest revenue contribution of the 4 product groups at 13%. FY 2019 Revenues for RE magnets and hard ferrite magnets are ¥80 Billion and represent 68% of the product group revenues. Remaining revenues are from the power electronics materials products. The financial report also discloses that on a weight basis that for FY2019, RE magnets are -36% lower year on year and hard ferrites are -39% lower year on year.

Assuming HML is in fact for sale, who are potential suitors? It seems that whether it is a strategic or financial buyer, some of the product groups will be spun off as separate businesses and floated or sold. The issue with the magnetic materials group is that most NdFeB manufacturers are probably not interested in the hard ferrite business, and are likely even less interested in the soft magnetics and ceramic product lines. So, it is possible that the Magnetic Materials product group will itself be further split and sold after acquisition.

On November 20, 2002, it was reported by Reuters that Apollo Global Management APO.N, Carlyle Group, KKR & Co., and Bain Capital are among potential bidders for HML. People with knowledge of the matter said a deal could potentially fetch more than $6.4 billion. At the time of writing, however, no formal announcement of any transaction has been announced.

Rare earth price increases dramatically in 2020

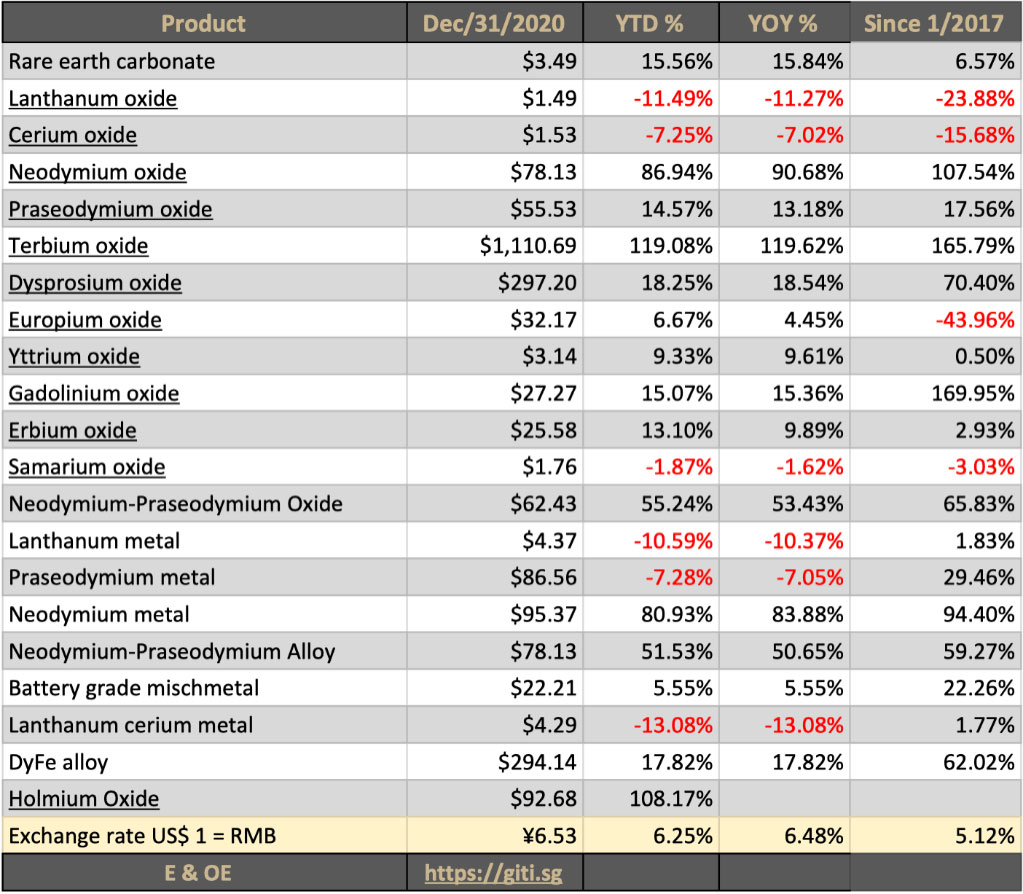

2020 saw the prices of all major Chinese-sourced rare earths increase, but especially those used in magnets. In particular, neodymium, which is the most common rare earth used in making magnets, increased by 81% since early in 2020. Several other key rare earths, including dysprosium and terbium, have also seen dramatic increases, as can be seen in the table below:

What’s driving these increases? As usual, it is a combination of factors. First, there is the short-term effect of the industry shut due to the COVID pandemic during the first half of 2020, followed by a rapid recovery in Q3/Q4 2020. Shortages of raw materials through to finished magnets occurred at every interface in the supply chain resulting in long lead-times and price increases. Next, we had the announcements by senior Chinese government representatives that export restrictions on REEs were under consideration. In January, China’s industry ministry proposed tightening regulation of the rare earth sector, including a stipulation that importers and exporters abide by foreign trade and export control laws. “Our rare earths did not sell at the ‘rare’ price but sold at the ‘earth’ price… because of competitive bidding, which wasted the precious resource,” Minister of Industry and Information Technology Xiao Yaqing said during a news briefing. However, after this sabre-rattling increase in RE, quotas were announced. Compared with the same period in 2020, the first batch of rare earth quotas of mining and separations have both been raised by more than 27% to 18.0kt and 17.5kt respectively in 2021, the largest increase since 2018. Third, and more concerning for the long term, is the ability of all critical steps in the RE supply chain to meet the market demand predicted over the next decade. Much of the growth in NdFeB magnets is being driven by governments around the world mandating a rapid switch from internal combustion engine to electric vehicle drive systems. In addition, the expanding role of wind turbines in the global electrical energy mix is creating an enormous demand for NdFeB magnets. Additional mining resources and separation capacities are being developed, however, a breakthrough in magnet technology is also required that will consume the over production of Ce and La materials currently being stockpiled.

Electrification of transport

It was recently reported by David Kramer in Physics Today that the global market for EVs could grow at a stunning 36% annually over the next decade if nations adhere to commitments made under the 2015 Paris Agreement, according to the International Energy Agency. This means somewhere between 60 to 100 million EVs of all types would be produced in 2030. This is estimated to consume anywhere between 60 to 100kt of NdFeB magnets and become the largest application sector for these materials. The European Union, the UK, and California have announced bans on sales of new internal combustion vehicles, to take effect in 2035. President Biden has proposed adding 500,000 EV charging stations by 2030 and providing new incentives for buying EVs. Today, most EV propulsion motors use permanent magnets because of the desired speed-torque characteristics and efficiency gains over induction designs.

In addition to land-based vehicles, the early seeds of electric marine and aerospace transport are beginning to become reality as well. Exciting but challenging times are ahead for the magnet industry!